- Ethereum’s burn rate hit a yearly low due to reduced network fees, with current gas fees ranging from 5 to 10 gwei.

- Ethereum’s price surpassed $3,200 before dropping to $3,108, while Bitcoin’s price movements remained more stable in comparison.

Recent transactions in the Ethereum (ETH) market have brought attention to large holders, often referred to as whales. These actions have attracted interest amid ongoing price fluctuations and market uncertainties.

The movements, involving substantial amounts of ETH, have prompted discussions about their potential impact on Ethereum’s value and broader market sentiment.

A whale who bought $ETH a year ago seems to be selling $ETH to take profits.

He withdrew 12,906 $ETH($24.39M) from #Binance at $1,890 a year and deposited it into #Lido.

He withdrew 7K $ETH from #Lido when the market dropped on Apr 30 and deposited it into #Binance 15 minutes… pic.twitter.com/wi4qSUllY1

— Lookonchain (@lookonchain) May 6, 2024

In one case, a large holder, who purchased ETH at $1,890 previously, moved 12,906 ETH worth around $24.39 million from Binance to Lido, as reported by LookOnChain, an on-chain data analysis service.

Subsequently, this investor withdrew 7,000 ETH from Lido and redeposited it into Binance, generating profits over $16 million. Such actions reflect a trend where large holders are securing profits, hinting at a conservative view regarding Ethereum’s future price movements.

Further analysis of on-chain data reveals a reduction in the frequency of large transactions, corresponding with times of price instability for Ethereum. This trend suggests that the actions of large holders, or whales, could be impacting ETH’s price behavior.

The drop in substantial transaction volumes during volatile periods may indicate that ETH whales are re-evaluating their risk tolerance.

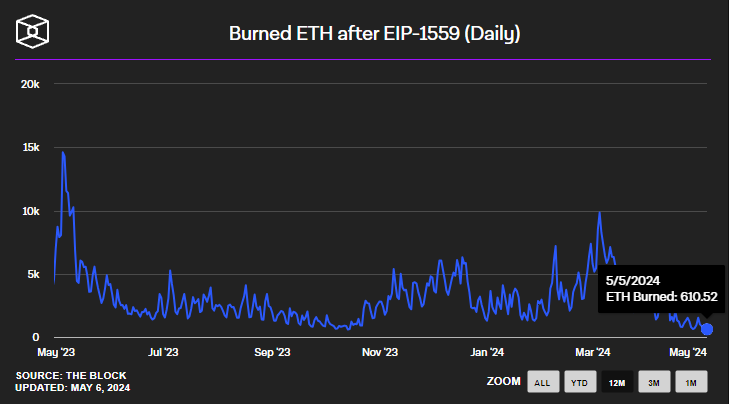

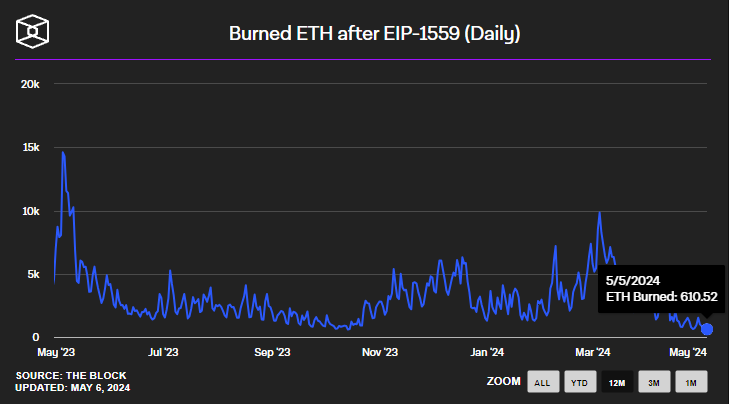

Ethereum Burn Rate Drops to Annual Low

On May 5th, Ethereum saw its lowest daily burn of the year at 610 ETH, due to decreased network fees. These fees, which fell to between 5 and 10 gwei, marked a significant drop compared to earlier months. From January to April, the usual daily burn of Ethereum was between 2,500 and 3,000 ETH.

This reduction in fees has directly resulted in less ETH being burned. Since the fee level influences how much ETH is destroyed, lower fees mean fewer ETH are removed from circulation, a process intended to reduce the total supply and potentially enhance its market value.

This decrease in ETH burning has altered Ethereum’s network from its earlier deflationary model. The London hard fork, which took place in August 2021, changed how Ethereum’s fee system works, connecting higher fees to more ETH being burned.

Recent patterns suggest rising inflationary pressures on Ethereum’s supply, currently expanding at a rate of 0.49%. Yet, this scenario might shift back to a deflationary mode if the amount of ETH burned exceeds the amount issued.

Gas Fees and ETH Burning: Key Elements of Ethereum’s Economic Model

Gas fees and ETH burning are key components of Ethereum’s economic model. Low gas fees benefit users by reducing transaction costs. However, this results in a decrease in the amount of ETH burned, impacting the network’s deflationary characteristics.

The London hard fork, also known as EIP-1559, was introduced in August 2021 and changed Ethereum’s fee system. It established a base fee, which is burned, and a priority fee, which serves as a tip for validators.

The base fee varies based on network usage, so when demand is high, fees increase, leading to more ETH being burned and removed from circulation.

This burning process can help reduce the overall supply of ETH, which is intended to support its value over time. The priority fee remains optional for users who want to speed up their transactions.

Ethereum’s Price Movements and Market Response

Ethereum’s price recently broke through the $3,200 resistance level, hitting $3,221 on Binance, before falling to $3,074.74. Although Ethereum’s price often moves in tandem with Bitcoin, it tends to face larger declines than BTC.

This relative underperformance compared to other leading cryptocurrencies may be prompting whales to reevaluate their holdings, potentially looking into other assets or diversifying their portfolios.

Register at Binance