1. Introduction

This is the continuation on Sapphire Strat Maker and Sapphire Strat Maker Alt (Free) expert advisor (enjoy the price discount while it is still active!) – an EA which allows you to create your own strategy without coding. This is the beauty of this Expert Advisor: create your own strategies – be creative – and don’t be locked to a single strategy anymore. Optimize the parameters you want to find the best sets and you’re ready to go!

Please, note that some of these features may only be available in the full version.

Before continuing, check out the other blog posts:

Today we are gonna take a look on different categories that may help you create your own strategy with Sapphire Strat Maker (or at least help the process of developing your own EA).

2. Types of strategies

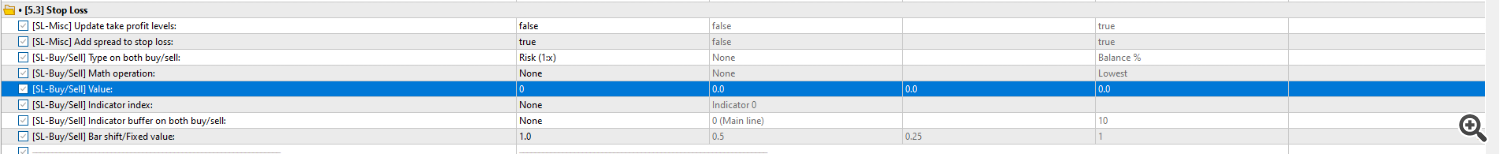

In the process of thinking a new strategy, I usually define three main categories, two of which subdivide into two other sections:

As we can see, we have three main types: trend strategies, countertrend strategies and consolidation strategies.

Trend strategies and countertrend strategies can also be subdivided into momentum and reversal strategies.

Momentum strategies try to catch the current movement – if it’s a trend, it goes on the trend direction; if it’s a countertrend, it tries to follow the opposite trend direction (thus, countertrend).

Reversal is quite the opposite, that is, it expects that the current movement will fail to continue and will reverse – thus, if used in a trend strategy, it expects the movement to go against the trend; if used in a countertrend strategy, it expects the trend to come back and go on.

This definition can be visualized in a table like this:

| – | Momentum | Reversal |

|---|---|---|

| Consolidation | – | – |

| Trend | Follow the current trend movement | Expects the trend to reverse (usually on an overbought/oversold level) |

| Countertrend | Follow the current countertrend movement | Expects the countertrend to reverse (usually on an overbought/oversold level) |

By dividing your strategies like this, you can create robots that work on different market circumstances and that may reduce your losses. Imagine a position that buys on an uptrend and sell on the same uptrend. Depending on how you configure your EA, both of them may be profitable (but note that both may lose aswell; a good portfolio of robots, however, can take care of this).

Let’s make a strategy and see how we can define the best indicators/parameters for it.

In this example, I want to create a countertrend reversal strategy. Since it is a countertrend, I must define a way to check to which direction the trend is going. Next, since it’s a reversal, I must check for an indicator that tells me a good point at which this countertrend has gone too far.

There’re two quite interesting indicators that do these stuff: moving averages and slow stochastic.

For this strategy purpose, I’ll assume that we are in an uptrend if the price is above the moving average and in a downtrend if the price is below it. Also, we must buy when the asset is oversold and sell when it is overbought – these conditions can easily be detected if the stochastic is below 20 and above 80, respectively.

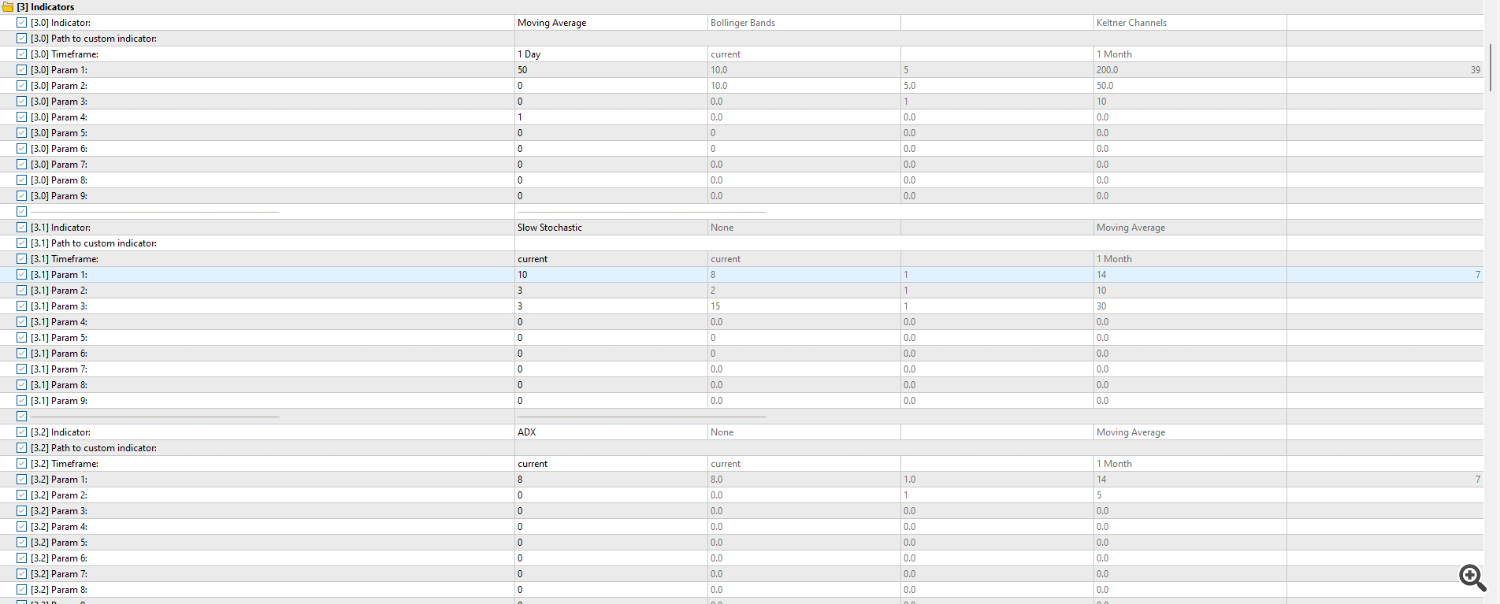

I’ll also add an ADX to check the current trend force and will optimize it’s parameters to check how it better performs (that is, I want to know the best period, the value to compare against ADX and whether is better if ADX is below or above this level). An optimization was also done on the moving average and stochastic periods. All other indicator parameters were left as default.

After optimizing, these were the chosen parameters for the indicators:

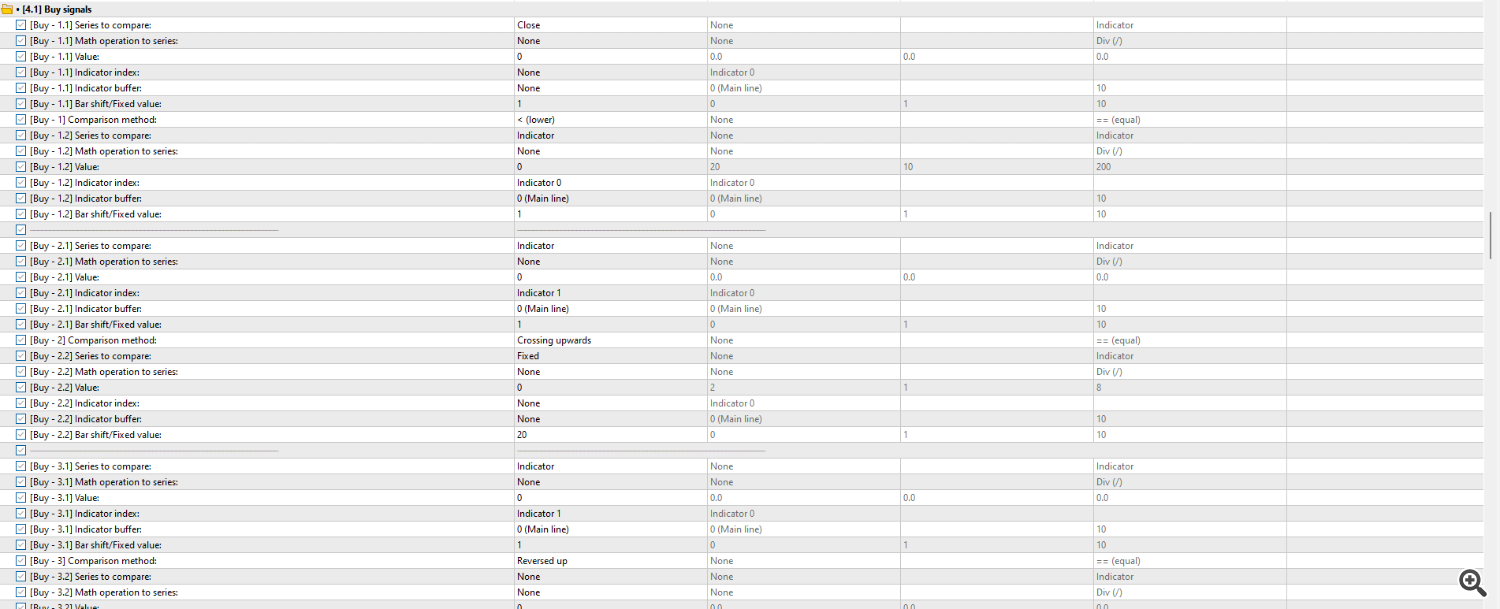

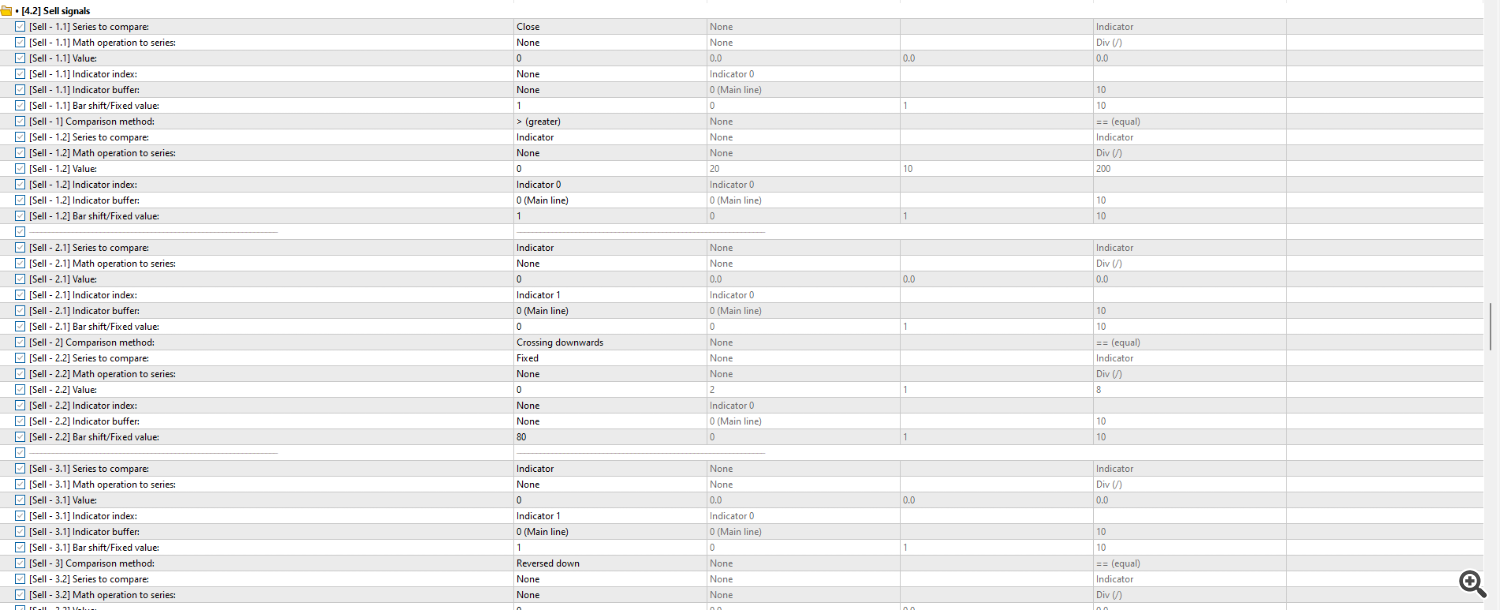

The entry signals were defined as following: a buy position must be opened when the current close price is below the moving average (countertrend), when the slow stochastic is below the oversold level and also when it is below the level 20 (indicating a reversal). A sell position must be opened when the current close price is above the moving average (countertrend), when the slow stochastic is above the overbought level and also when it is above the level 80 (indicating a reversal).

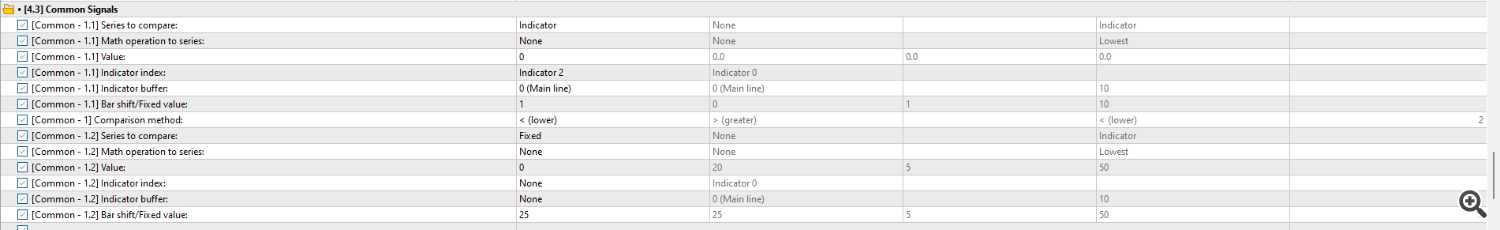

To open both types of positions, after optimizing, we found out that the ADX must be below the level 25.

This is how the conditions were set:

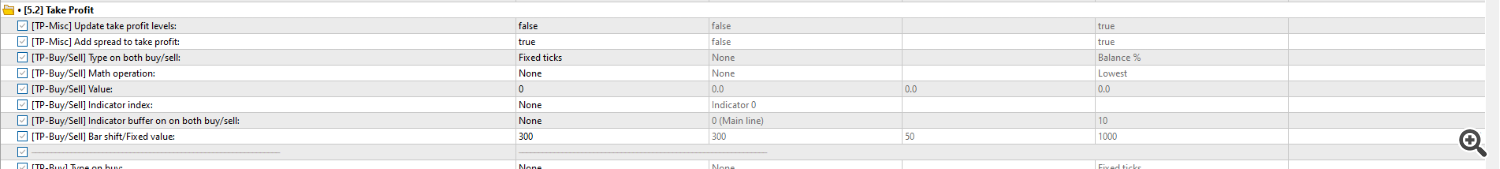

There’re many options to choose for tp/sl. I’ll take the simplest: take profit by a certain amount of ticks. The stop loss will be the tp value multiplied by another value. Both will be optimized.

These are the results after optimization:

To keep it simple, I’ll not set any other option, like the risk management, trailing stop loss/take profit, breakeven, etc.

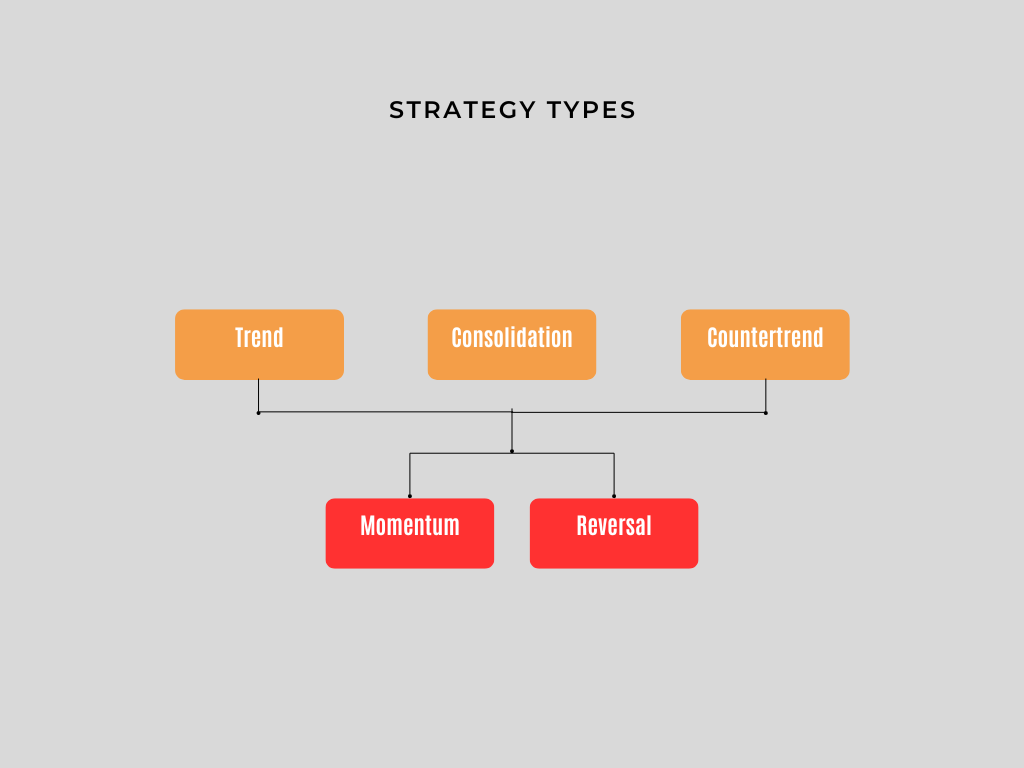

The volume is set to 0.1; the timeframe is M15; the testing period is from 2018.04.01 to 2024.04.01; my balance is $1,000.00; modelling is Open prices only.

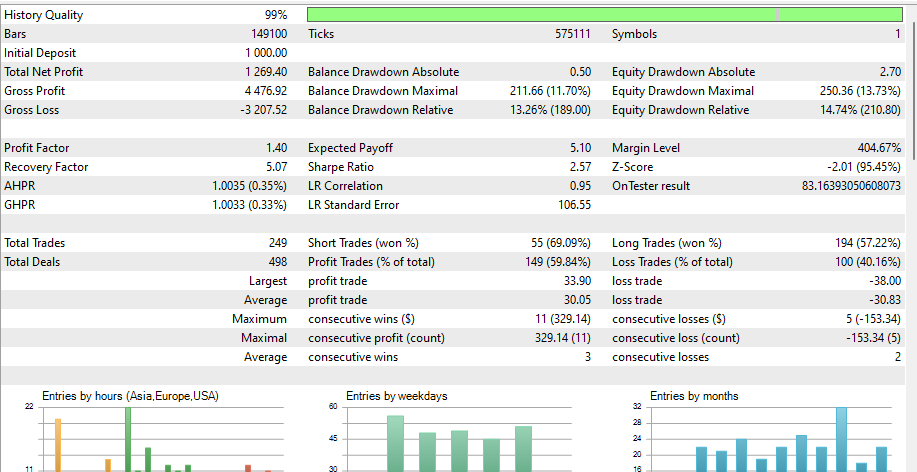

Now that we’re ready to go, these are the results:

Pretty good!

Notice that I could use Slow Stochastic to also buy/sell on for a trend strategy (like, it crosses the 50 level upwards or downwards) and the many other (30+ or custom) indicators included in the EA.

ps.: pay attention this does not guarantee a future profit.

ps2.: note that these tests were performed on a broker that provides a 0 spread derivative of EURUSD for a small commission . The results already include this commission. Thus the results may be different from yours – if so, optimize the strategy so it suits your needs.

Register at Binance