- Recent large outflows from Ethereum and a slight price drop are indicative of the varying sentiments in the market.

- Whale Ethereum holdings are increasing in spite of the selling pressure on the market as a whole, suggesting that significant investors are still confident in Ethereum.

The significant outflow of Ethereum from exchanges over the last week is a signal that market observers frequently interpret as bullish. The most recent evidence, however, points to a more complicated situation developing.

Ethereum’s Price Fluctuations

The price of ETH, according to CoinMarketCap, is currently at roughly $3,124.29, having slightly decreased by 0.51% over the previous day. The cryptocurrency has shown a strong position over the past week, with a growth of 1.86%, despite this slight decline.

Following the notable accumulation of roughly 15,389 ETH by well-known cryptocurrency investors, including Justin Sun, the founder of TRON, there has been a recent surge in price, in line with what ETHNews previously disclosed.

Over 260,000 Ethereum, or more than $781 million, have been removed from exchanges in the last week, in an astonishing outflow of the cryptocurrency.

The well-known analyst Titan of Crypto brought attention to this enormous movement in a tweet. Large-scale withdrawals of this kind usually reflect investor confidence and an optimistic view from key holders.

Crypto exchanges witnessed an outflow of over 260,000 #ETH equivalent to more than $781 million within the past 7 days.

It’s time for #Ethereum shine. ✨🌕 pic.twitter.com/jT1aocjvbI

— Titan of Crypto (@Washigorira) April 24, 2024

However, over the past day, the market has taken a negative turn, though this does not necessarily mean all flows were pessimistic.

According to data from CMC, there have been signs over the last week that if nothing changes, Ethereum may be on the verge of sustaining more downward selling with the net deposit of Ethereum on exchanges, as well as supply increases. These are both proof that investors are looking to sell and unsuccessfully covering their tracks.

Continued Whale Accumulations

It’s interesting to note that whale investors remain despite the price decrease. Despite market swings, the top Ethereum addresses have seen a boost in their holdings. Despite broader selling pressure, this whale accumulation tendency may indicate various investment classes are using different methods.

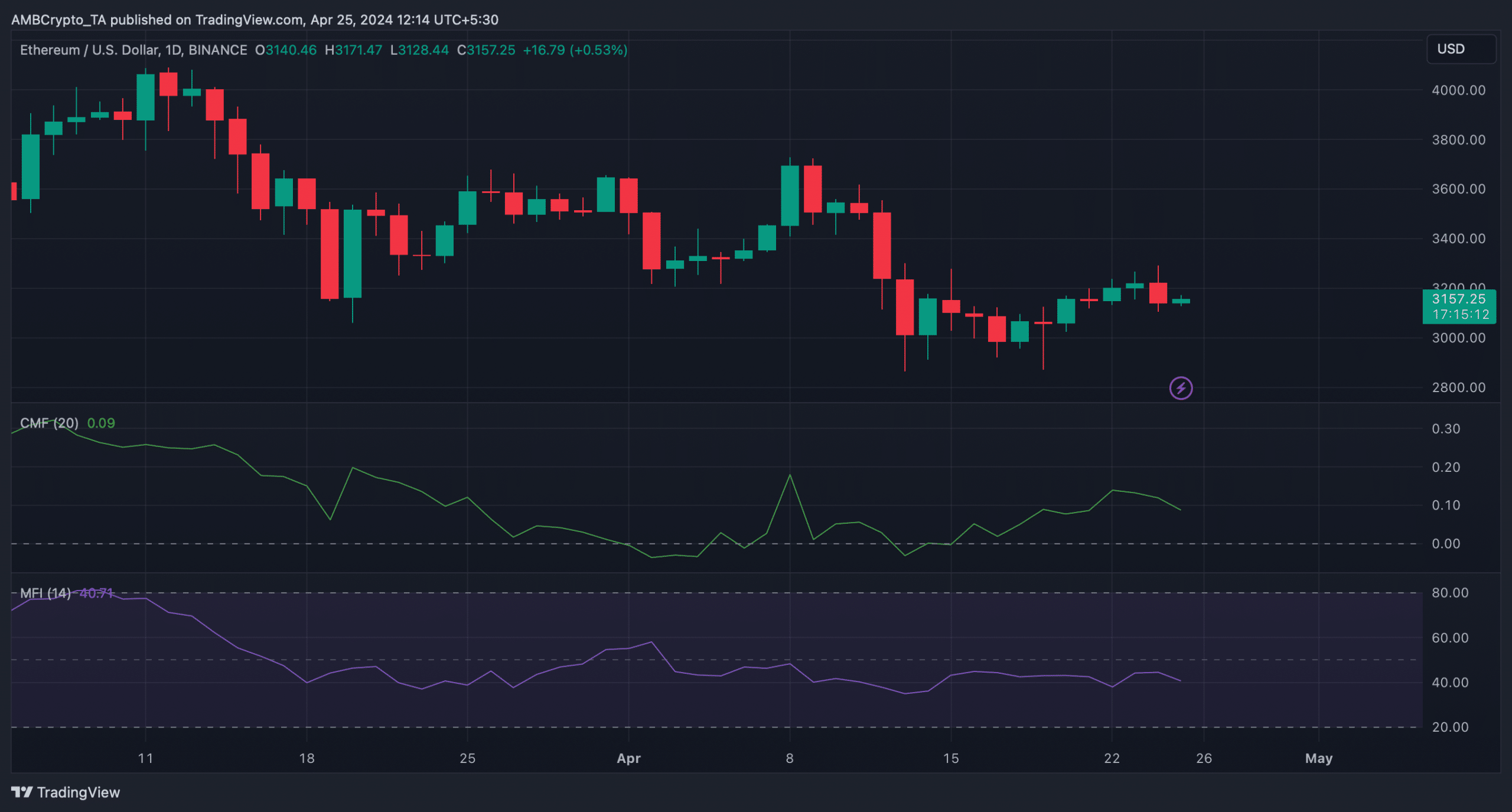

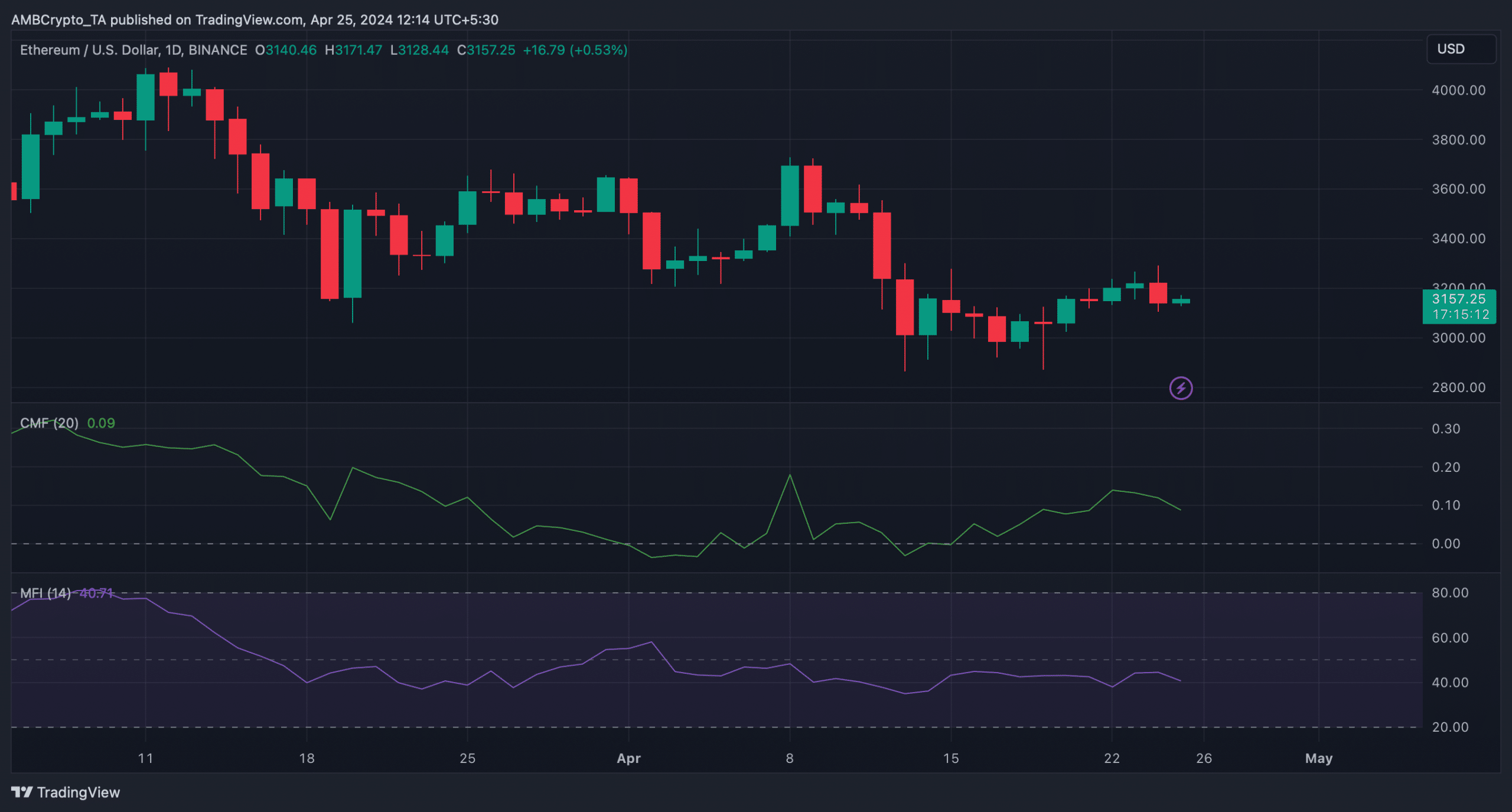

Technical indications and Ethereum’s derivatives measures point to a less hopeful picture. The rising funding rate of the token usually portends a decline in price. Both the Money Flow Index (MFI) and the Chaikin Money Flow (CMF) started to go south, suggesting that the market may be ready for more price reductions.

Register at Binance