- Miners’ revenue depends increasingly on transaction fees due to diminishing block subsidies, highlighting the importance of new protocols.

- Protocols like Ordinals and Runes must stabilize popularity to ensure consistent miner revenue despite fluctuating transaction demand.

Bitcoin’s innovative use of protocols such as Ordinals and Runes could be crucial for sustaining miner income as the cryptocurrency faces more halving events, according to insights shared by the cryptocurrency mining pool ViaBTC.

#Bitcoin Miner Revenues Explode Thanks to Runes: Should You Load Up on Miners?

👇1-12) Bitcoin miner revenues have exploded with the launch of Runes, a new fungible token standard created by creative organelles. Runes allows people to inscribe arbitrary data on Bitcoin-like art.… pic.twitter.com/cj1VUuHUq7

— 10x Research (@10x_Research) April 24, 2024

These applications drive transaction fees, which are becoming increasingly vital for miners as block rewards continue to diminish.

Historically, Bitcoin miners have depended on block subsidies and transaction fees for their revenue. The block subsidy, which halves approximately every four years, influences long-term miner earnings.

For instance, prior to the Ordinals protocol launched in January 2023, miners primarily earned from these two streams. However, with the integration of new applications on the Bitcoin network, such as Ordinals, Runes, and BRC-20 tokens, there is a noticeable increase in on-chain transactions, which in turn boosts transaction fees.

ViaBTC experienced a surge in earnings on April 20, when it mined the halving block at block number 840,000. This block included a record-setting 37.6 BTC in transaction fees alone, amounting to about $2.4 million at that time.

Combined with the new block subsidy of 3.125 BTC, the total reward from this single block reached 40.7 BTC. This substantial fee was primarily driven by transactions related to memecoins and nonfungible tokens, specifically through activities like inscribing “rare satoshis” and tokens using the new Runes token standard.

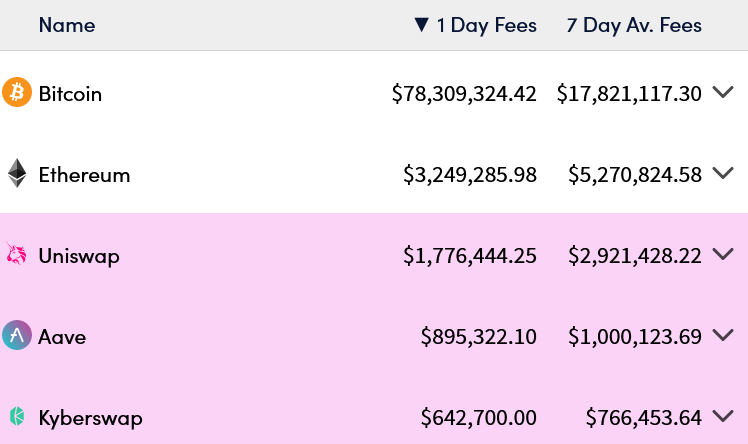

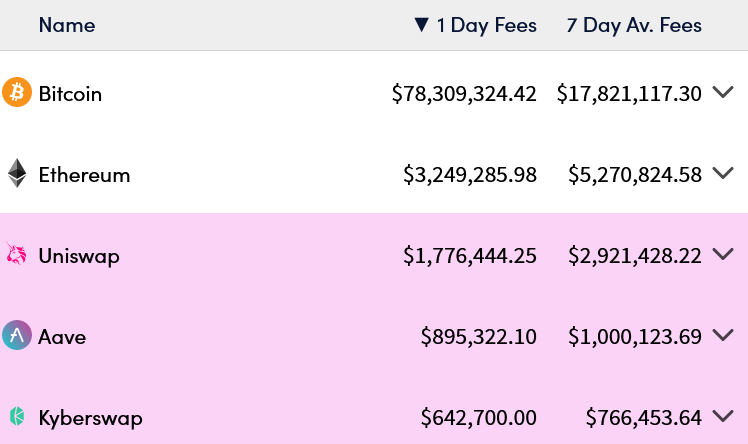

This event highlights the potential of high transaction fees to compensate for the decreasing block subsidy. The halving day alone saw Bitcoin miners earning a staggering $78.3 million, surpassing the revenue from fees garnered by Ethereum stakers and Uniswap liquidity providers for most of the days since the halving event. These figures underline the increasing importance of transaction fees in the Bitcoin mining ecosystem.

The shift towards transaction fees as a primary revenue source was anticipated by Bitcoin’s creator, Satoshi Nakamoto. As the network evolves and the application layer expands, there is an expectation that these fees will play a central role in compensating miners. This block subsidy reduces after every halving, making transaction fees a more prominent part of miner revenue.

However, the popularity of protocols like Ordinals, Runes, and BRC-20s has fluctuated, leading to some instability in mining revenues. Despite these challenges, ViaBTC, which has been operational since 2016 and survived three halving events, continues to mine successfully.

Magic Eden is all over Hong Kong spreading the good word of Ordinals & Runes 🇭🇰

Let’s keep growing the space together🪄 pic.twitter.com/oIbHqoA8aW

— Magic Eden on Bitcoin 🟧 (@MEonBTC) May 9, 2024

With miners from 118 countries contributing to its hash rate, ViaBTC remains a player in the global Bitcoin mining sector, adapting to the changing of blockchain technology and cryptocurrency mining.

Register at Binance