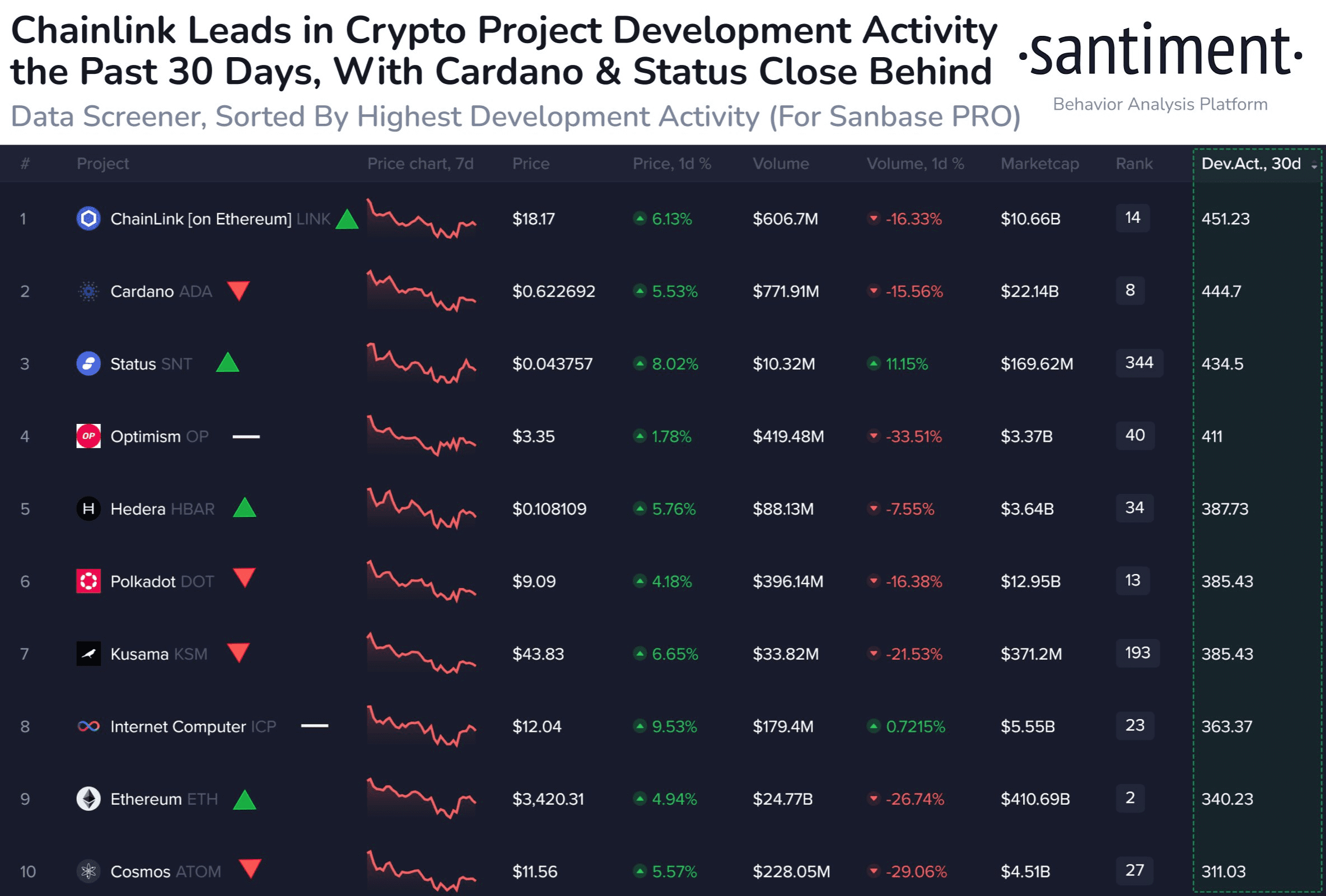

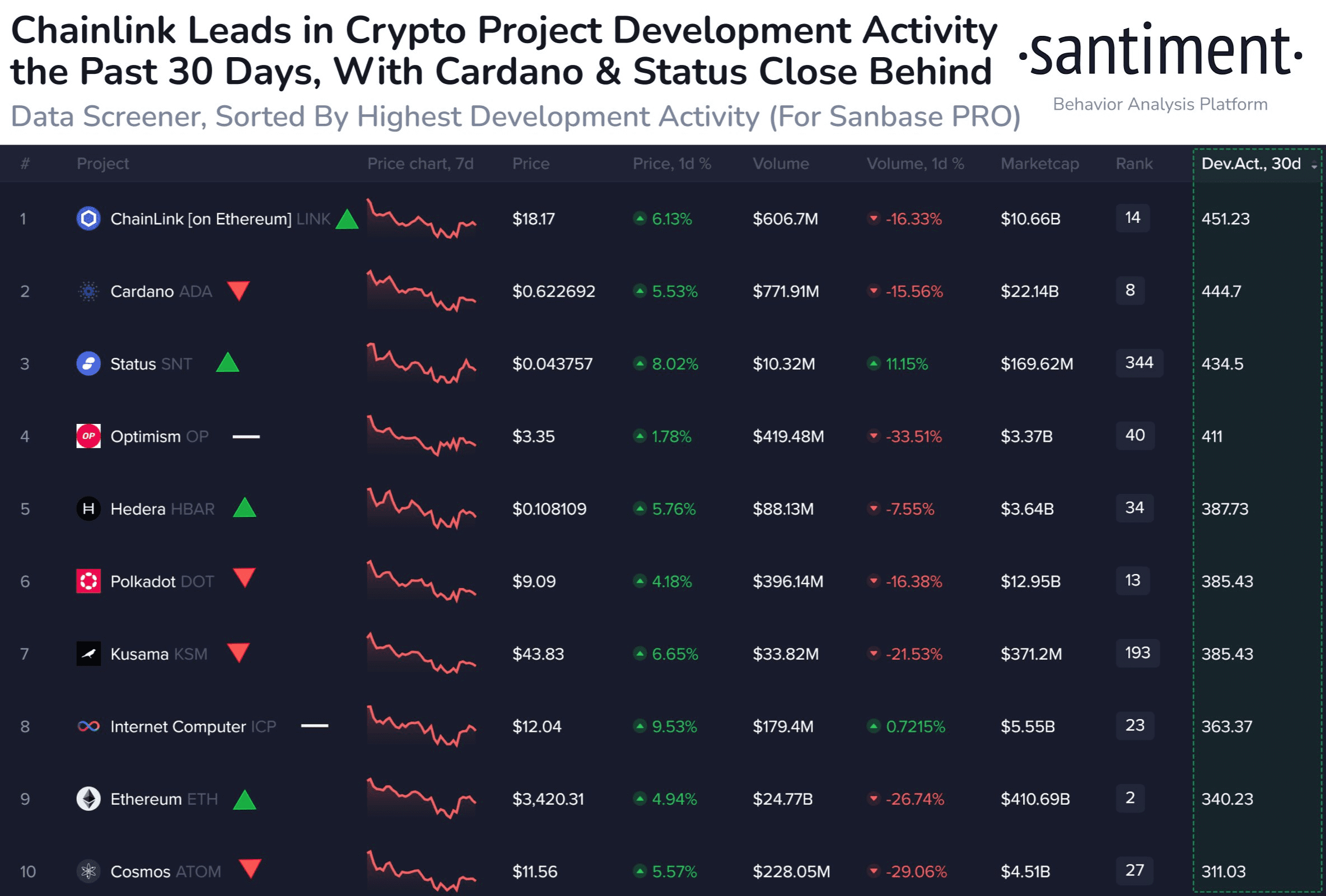

- Santiment reveals Chainlink, Cardano and Status as leading altcoins in developer activity in the last 30 days.

- The increase in developer activity on LINK suggests efforts for integrations and attracting institutions to its platform.

Cryptocurrency intelligence firm Santiment on Thursday revealed a list of altcoins that have seen the most developer activity over the past 30 days. This report highlights that Chainlink (LINK), Cardano (ADA) and a 2017 surprise called Status have captured the attention of developers, which could indicate a boost in value when the fruits of these activities materialize.

Chainlink and Cardano lead this movement, according to Santiment’s report, with developer activity scores of 451.23 and 444.7 points, respectively. The increased activity at LINK suggests an effort to increase integrations and attract institutions to its platform.

The Chainlink team has been particularly active within the Ethereum network, aiming to enhance the web3 ecosystem through the integration of reliable price feeds and bolstering interoperability.

Conversely, the Cardano is experiencing swift expansion within the web3 domain, boasting a Total Value Locked (TVL) exceeding $415 million and a stablecoin market capitalization near $20 million.

Presently, efforts within the Cardano network are concentrated on developing second-layer scalability options, notably the expansion of the Hydra Head protocol.

Pricing Implications and Expectations

After moving out of the bear market in the latter part of last year, the price of Cardano (ADA) has started to create a cup-with-handle base pattern, often indicative of the beginning of a fresh bullish phase.

Boasting a fully diluted market value close to $28 billion, it’s crucial for it to surpass the 80 cents mark in the upcoming weeks to solidify its upward momentum.

According to the weekly Fibonacci extension, the price of ADA is targeting a new liquidity range of $1.2 to $1.5 in the forthcoming weeks.

Even though the Chainlink versus Bitcoin pairing is trading near the bear market’s lowest levels, this mid-cap altcoin is unmistakably aiming for a record high (ATH) when measured against the US dollar.

The analyst’s observations focus on Chainlink’s price action against Bitcoin on the daily chart, where LINK/BTC appears to have reached a flipping the 20-period simple moving average (SMA) resistance .

This development is particularly significant as the 20-period SMA is a widely used technical indicator that traders closely monitor for potential trend reversals and identification of support and resistance levels.

Register at Binance