- BlackRock and Ondo cater to different markets with minimum investments of $5 million and $100,000 respectively, broadening access.

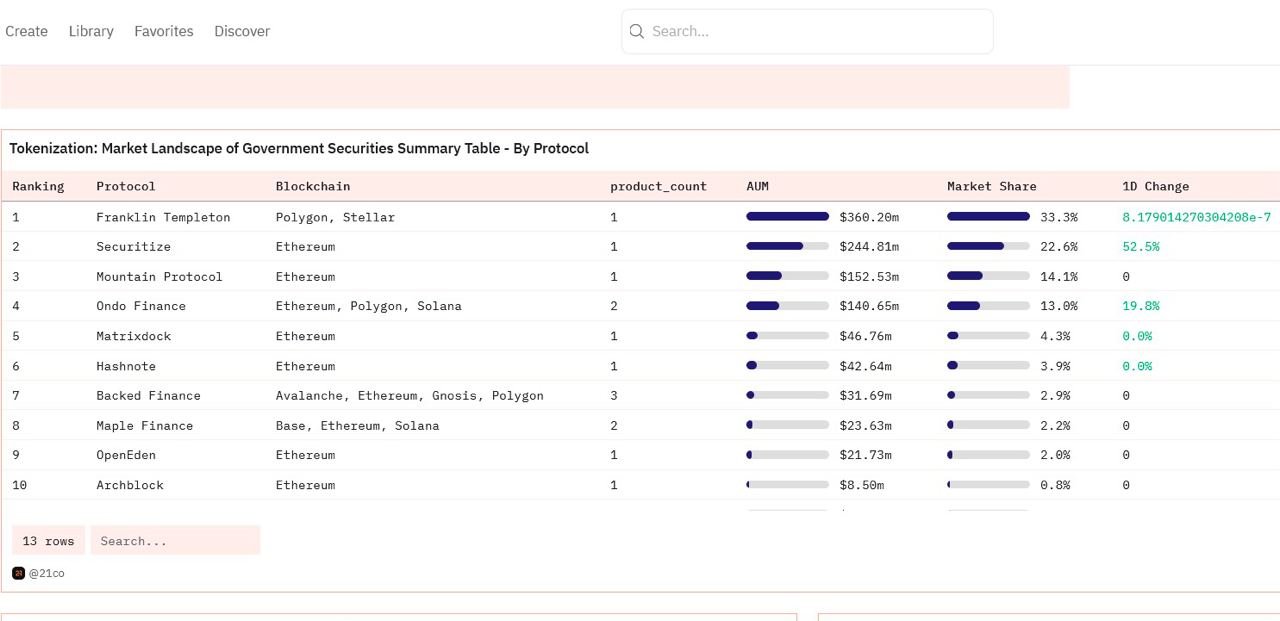

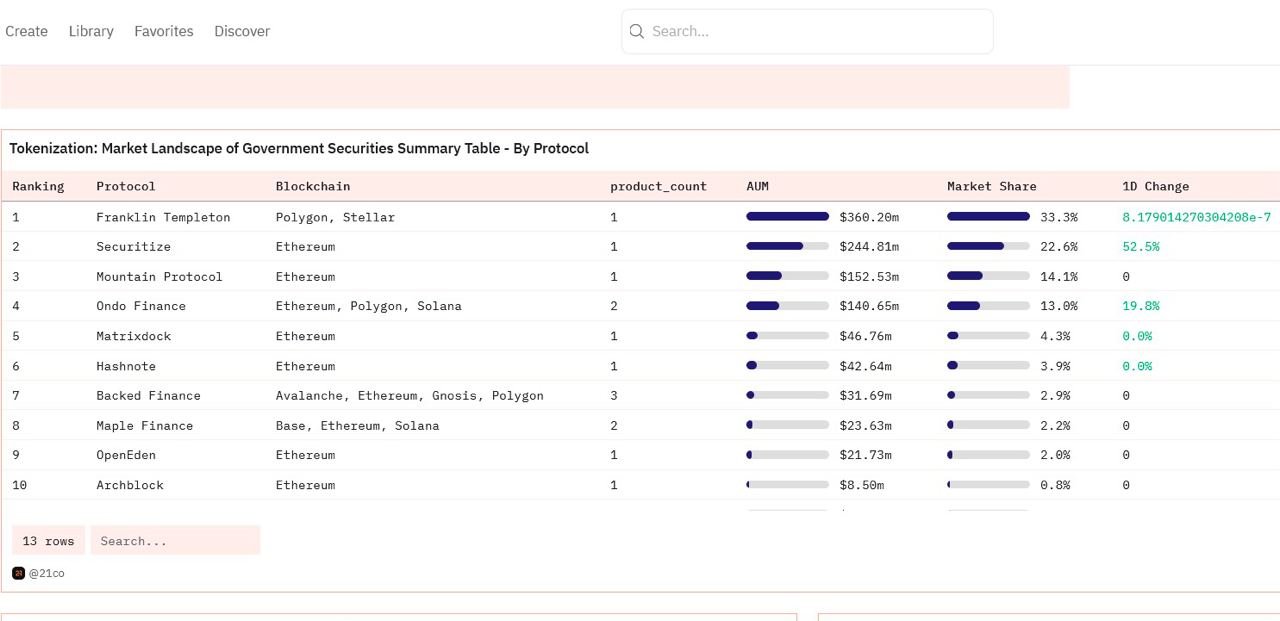

- Comparison with Franklin Templeton’s FOBXX shows BUIDL’s rapid growth, highlighting the burgeoning interest in tokenized money market funds.

Just a week after its announcement, BlackRock’s foray into digital finance, the BlackRock USD Institutional Digital Liquidity Fund (BUIDL), has garnered significant attention, accumulating $245 million in assets from seven investors.

Ondo Finance, known for tokenizing BlackRock ETF funds, contributed $95 million to BUIDL, accounting for 38% of the fund’s total value. Among the other investors, two have invested $50 million each, one has contributed $35 million, and four others have added $5 million each.

8/ Ondo Finance & Superstate: Tokenizing RWAs

What if you could trade bonds or real estate at the speed of the internet? @OndoFinance & @superstatefunds are making it happen.

It’s one of DeFi’s fastest-growing segments, with $4.3B+ of RWAs having been tokenized on blockchains. pic.twitter.com/hbjoLgtrk4

— Bitwise (@BitwiseInvest) March 22, 2024

This development places BlackRock in what appears to be a competitive stance with Ondo Finance, yet the collaboration seems to be mutually beneficial. Traditionally, redeeming the Ondo tokenized money market fund (OUSG) required a waiting period due to the two-day settlement of traditional securities.

However, with this new venture, Ondo anticipates offering its investors the ability to invest and redeem funds instantly, around the clock, every day of the year.

You may be interested in: BlackRock CEO Unfazed by Ethereum Security Debate, Eyes Ether ETF

Although BlackRock and Ondo initially seem to cater to different market segments, with BlackRock’s minimum investment set at $5 million and Ondo’s OUSG at $100,000, this collaboration offers added reassurance to Ondo investors by making the BlackRock BUIDL investment visible on-chain.

8/ Not only does this further validate our original concept of a tokenized US Treasury fund, but it also bolsters our thesis that tokenization of traditional securities on public blockchains represents the next major step in the evolution of financial markets.

— Ondo Finance (@OndoFinance) March 27, 2024

Interestingly, Ondo boasts 42 token holders, six of whom have investments exceeding $5 million. Notably, a wallet containing $14 million is linked to Ondo’s DeFi protocol, Flux Finance. The assets from the remaining five major investors total $60 million, nearly two-thirds of OUSG’s funds.

Ondo Finance has allocated $95M of OUSG’s assets into @BlackRock’s BUIDL, as the tokenized fund draws $240M since its debut.https://t.co/hFrtDq0Auf

— Ondo Finance (@OndoFinance) March 27, 2024

Technically, these five investors could directly invest in BUIDL. However, OUSG caters to a global audience, whereas BUIDL operates under Rule 506c, limiting it to U.S. accredited investors.

You can read: BlackRock Enters Tokenization Race: Launches Ethereum-Based Fund Amid Regulatory Rumors – Is ETH in Danger?

BlackRock’s BUIDL could potentially rival Franklin Templeton’s FOBXX digital money market fund.

Over a period of two years, FOBXX succeeded in gathering $270 million in assets under management (AUM), with its current tally standing at $358 million, supported by around 385 investors.

Register at Binance