Exploring the Implications of Bitcoin’s Fourth Halving on Miners, Market Dynamics, and the Blockchain’s Security.

On April 20, the Bitcoin reward received by miners for adding a block was slashed in half. The fourth halving in Bitcoin history went as intended, effectively reducing Bitcoin’s inflation from 1.7% to 0.83% and miners’ revenue from 6.25 BTC to 3.125 BTC per block.

Now, bitcoin is officially scarcer than gold with its current supply inflation of 2.3%, and its “store of value” narrative is getting even stronger (source: Glassnode).

However, amid the celebrations within the Bitcoin community, questions arise about how the miners have responded to the halving. After all, this group, responsible for the very survival of the Bitcoin blockchain, has just seen its revenues cut in half. Last week’s Coinshares Report showed that the weighted average cash cost of mining 1 BTC in Q4 2023 was approximately $29,500; post-halving, it is approximately $53,000.

With their main source of revenue slashed, the miners could decide they are no longer interested in Bitcoin and deploy their computational capacities to more stable and lucrative domains, such as AI. As Coinshares’ data shows, some already do.

However, if a lot of miners stop mining, Bitcoin’s hashrate will drop, reducing its security – an unfortunate scenario for the world’s safest and most robust cryptocurrency.

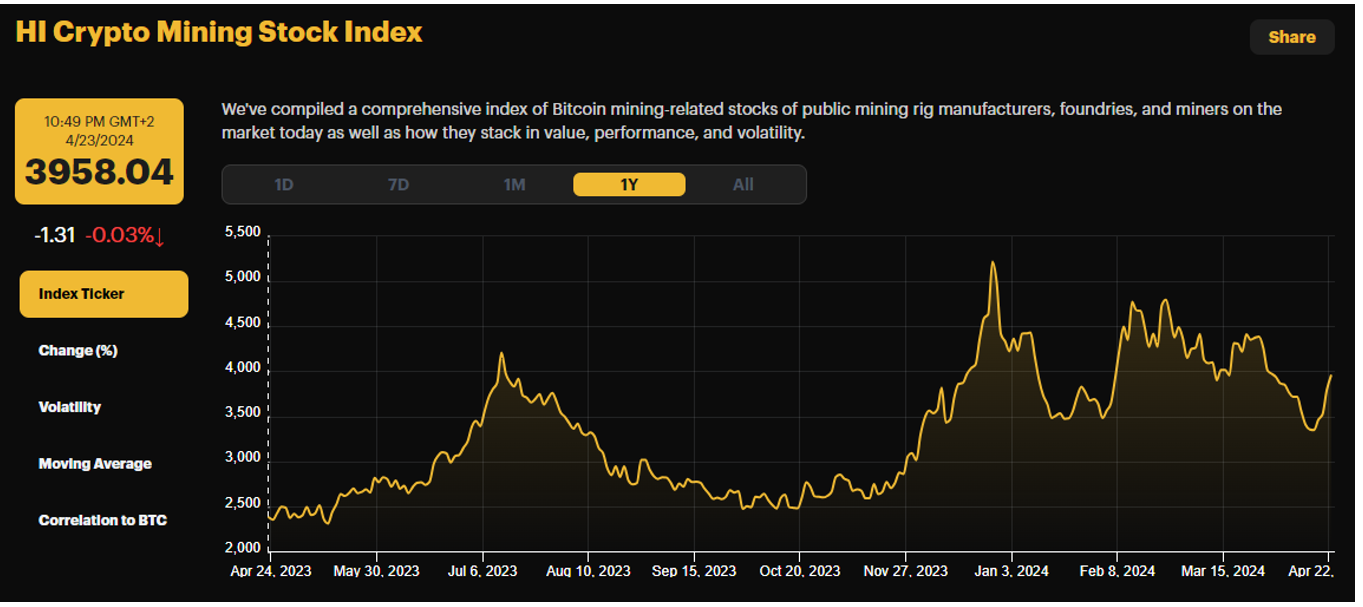

Curiously though, neither the Bitcoin price nor the mining companies’ equity dropped around the halving time. The Hashrate Index graph, tracking the weighted stocks of 25 crypto mining companies, even shows an 11% surge. This means that there are more factors to consider in their symbiotic relationship. Let’s dig a bit deeper into it.

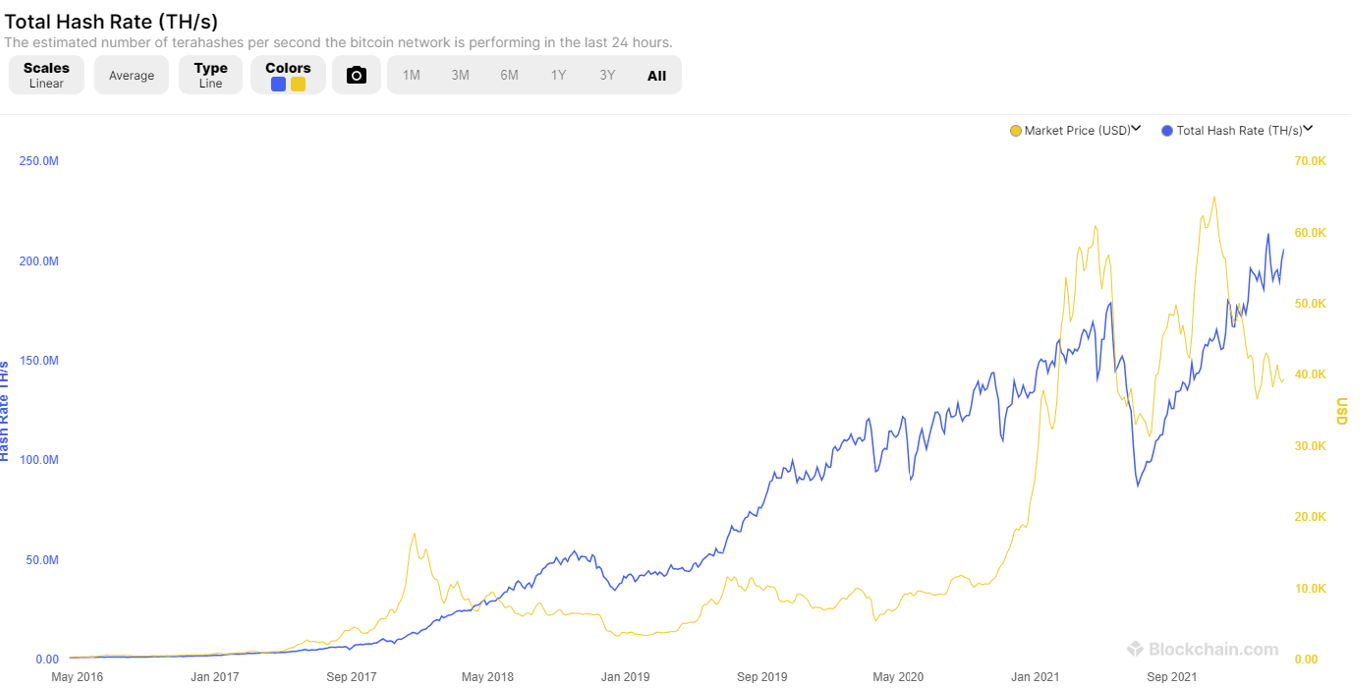

Bitcoin hashrate

Hashrate is the total combined computational power that is used to mine and process transactions on a blockchain network. It is measured in hashes per second (H/s) and indicates the performance and security of the mining network: the higher the hashrate, the more difficult it is to mine a new block and therefore the greater the network’s security.

An interesting fact about Bitcoin hashrate is that throughout halving epochs and market cycles, the absolute Hashes per second continued to grow. The one time that it dropped significantly was when China banned crypto mining in 2021, but it took the Chinese miners only 3 months to relocate their operations and come back online. According to Blockchain.com, Bitcoin’s hashrate is now at 620 Exahash/second, almost 6 times more than at the third halving in 2022, and 413 times more than at the second halving in 2016.

Such tenacity, even in the hardest times, indicates a strong belief in Bitcoin’s future as a global money. It also reflects continuous technological advancement, with more efficient hardware, and exploration of sources of cheaper electricity, notably at renewable and stranded energy sites.

Overall, despite BTC issuance being reduced by 50% each halving and some miners obliged to turn off their rigs in the depth of the bear markets, their aggregate security budget has been sufficient not only to sustain current OPEX costs, but also to stimulate further investment across both the CAPEX and OPEX domains.

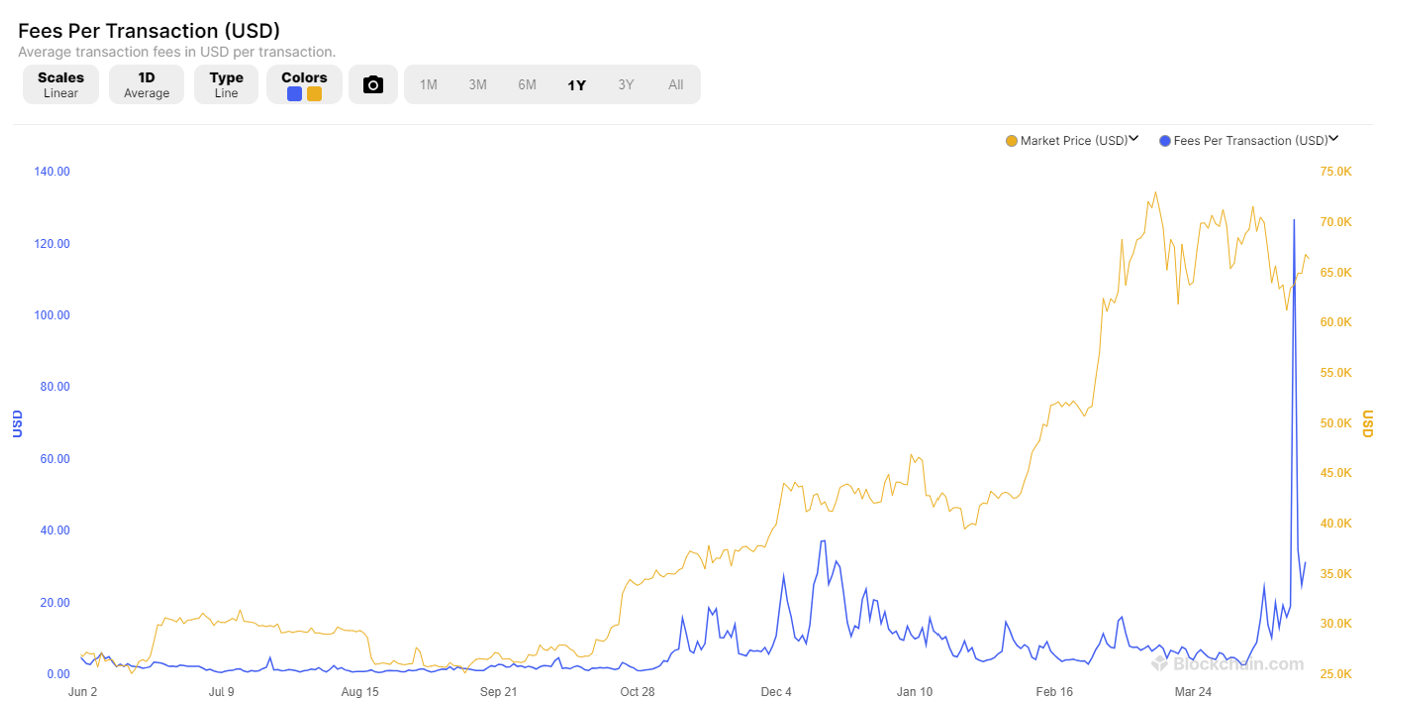

Bitcoin fees

Block rewards are the main source of miners’ revenue, but it is not the only one. The fees paid by the network users to speed up their transactions become increasingly important. These fees spiked to unprecedented highs (up to $146 for a medium-priority transaction) on the halving day due to the concurrent launch of Rune, a layer-2 solution allowing the minting of fungible tokens. Miners’ daily revenue exceeded $100 million, with more than $80 million coming from transaction fees, as outlined by Bernstein, a broker.

This situation was extraordinary, and Bernstein analysts warned that “investors should not extrapolate these fees into the future”. Indeed, the data from Mempool.space shows that medium-priority transactions are now costing $9.25.

However, as new Bitcoin-based protocols appear, such events could likely repeat. The last big spike in transaction fees happened at the beginning of the year, with the release of the Ordinals protocol allowing to embed arbitrary data into Bitcoin’s smallest unit, a satoshi. This opened Bitcoin to the creation of its own type of NFTs. The fungible token market remains largely untapped on the Bitcoin blockchain, and protocols like Rune could drive more activity to the network, increasing the fees.

All in all, maintaining profitability remains a continual challenge for Bitcoin mining companies, much like it is for many businesses. Some may struggle to adapt, but those who persevere will continue safeguarding Bitcoin’s security.

Register at Binance