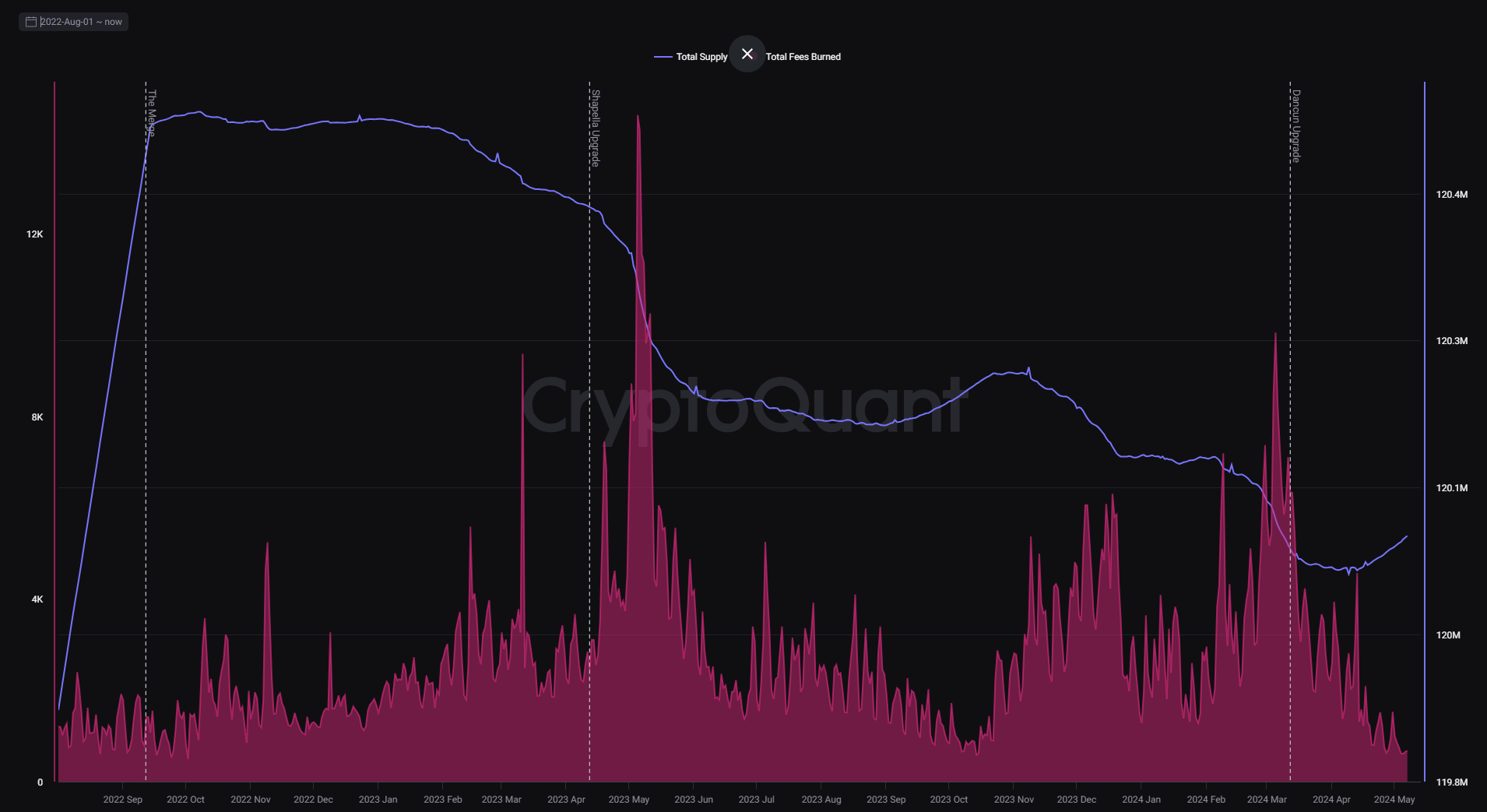

- Ethereum’s post-upgrade ether supply growth now exceeds burning, creating inflationary conditions instead of the previous deflationary pattern.

- Increased network activity is crucial to raise transaction fees and boost ether burning to return to a deflationary state.

The Ethereum network recently underwent the Dencun upgrade to reduce transaction costs and improve Layer 2 efficiency. However, this upgrade has resulted in an unexpected consequence: ether, the network’s native cryptocurrency, has shifted back to inflationary growth.

This outcome contrasts sharply with Ethereum’s prior characterization as ‘ultra-sound’ money, wherein its native supply was anticipated to decline, potentially increasing value.

Effects of the Dencun Upgrade

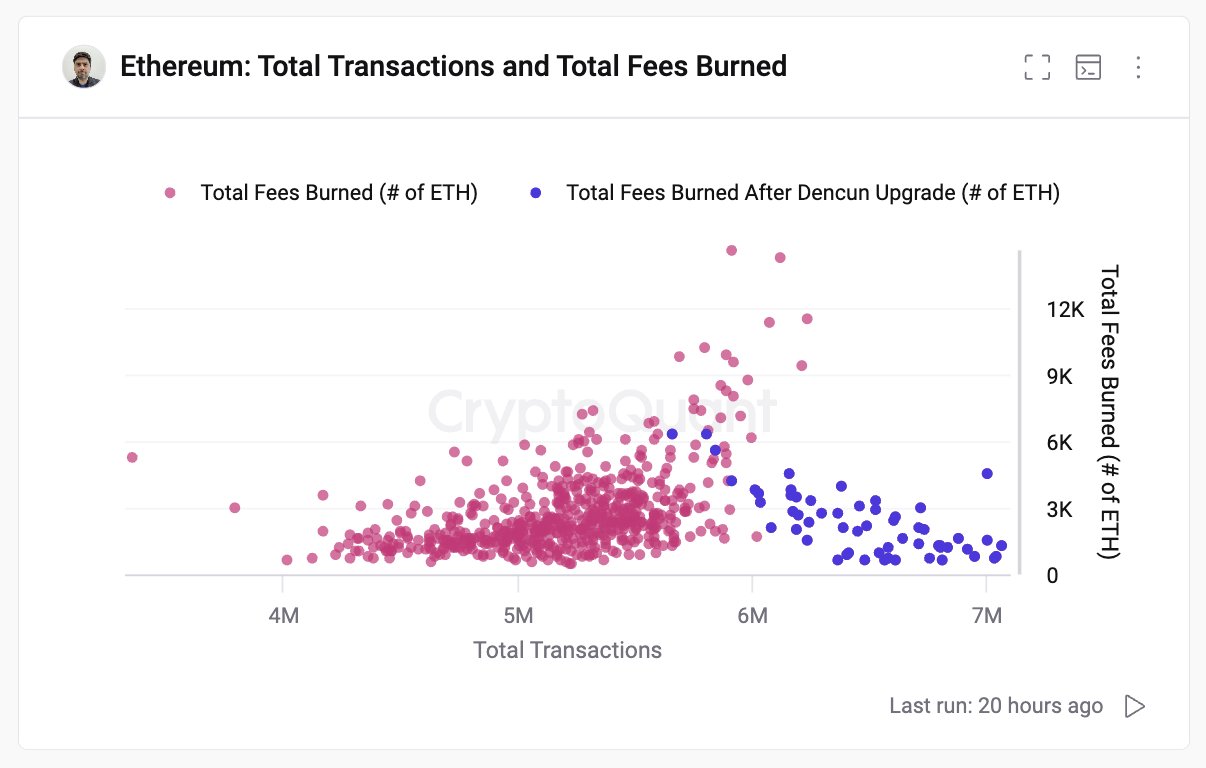

The Dencun upgrade successfully lowered Ethereum network transaction fees by over 90%, which greatly benefits those making transactions. However, it also reduced the volume of ether burned, or permanently removed from circulation.

Previously, this burning mechanism contributed to a deflationary trend, where the overall supply of ether steadily declined. Now, due to lower transaction fees, the rate of ether burned has decreased, reversing this deflationary pattern.

Reports from CryptoQuant indicate this has triggered the fastest growth in daily ether supply since the Merge, a previous major upgrade that shifted Ethereum’s consensus mechanism. The Merge was expected to solidify Ethereum’s reputation as ‘ultra-sound’ money, reducing energy consumption while also lowering ether supply via burning mechanisms.

Implications for Ethereum

This shift from deflationary to inflationary currency complicates Ethereum’s ‘ultra-sound money’ narrative, which hinges on a progressively decreasing supply. Now that Ethereum is issuing more ETH than it burns, this concept is under scrutiny.

Analysts at CryptoQuant believe a substantial increase in network activity is necessary for Ethereum to return to a deflationary trajectory. Increased network activity would theoretically drive transaction fees higher and speed up the burning rate, even if fees remain below pre-Dencun levels.

However, achieving this increased network activity might require further enhancements or modifications to the Ethereum network.

While the current inflationary state challenges Ethereum’s deflationary aspirations, the network remains popular due to its strong foundation in decentralized applications (DApps) and innovations in decentralized finance.

The Dencun upgrade has shifted the cryptocurrency sector for ether, indicating that Ethereum will need to find a balanced approach to its fee structures and supply dynamics to maintain its utility and appeal.

Register at Binance